Euler v2 is the credit layer of onchain finance. Modular by design, it empowers builders to create vaults that collateralise almost any kind of digital asset. This launch represents a pivotal moment in DeFi. With Euler v2, the possibilities for lending, borrowing, and building are endless.

Following a year of meticulous development and rigorous security audits, Euler v2 is now live, accelerating the modularity movement in DeFi. Unlike its predecessor, Euler v1, which was tailored to a particular use-case, Euler v2 is reimagined as a meta-lending protocol designed to support limitless use-cases for onchain credit, opening doors for seasoned DeFi users and institutional players alike.

The power of modularity

Euler v2 is modular by design, allowing builders to create highly customizable borrowing and lending vaults that break free from the constraints of traditional DeFi protocols. This flexibility enables a seamless blend of features, risk parameters, collaterals, and assets, transforming how lending markets operate. Euler v2 eliminates the fragmentation and capital inefficiency that has plagued isolated lending markets.

How it works

At the heart of the protocol is a development kit for deploying ERC4626 vaults. Vaults hold user deposits and are highly customisable. They are agnostic about governance, risk management mechanics, asset pricing, and much else. They can be designed to hold traditional crypto-native fungible tokens, tokenised real-world assets (RWAs) with permissioned transfer restrictions, natively-minted synthetic assets, or even non-fungible assets.

Passive lenders can use vaults governed by active risk managers, whilst lenders who prefer to manage their own risks can opt to use governance-free options. Users will be able to choose from risk-isolated lending and borrowing pairs for lending to long-tail or higher risk markets, to more capital-efficient cross-collateralised clusters of vaults that support lending of short-tail crypto majors or price-correlated assets such as stablecoins or ETH staking/restaking tokens. Anything is possible.

Vaults can be deployed in a permissionless fashion using the Euler Vault Kit (EVK) and chained to one another to recognise deposits in existing vaults as collateral via the Ethereum Vault Connector (EVC). Vault creators specify all the risk/reward parameters for their vaults and dictate whether their vault is to retain governance for active risk management or revoke governance to allow lenders to manage their own risk.

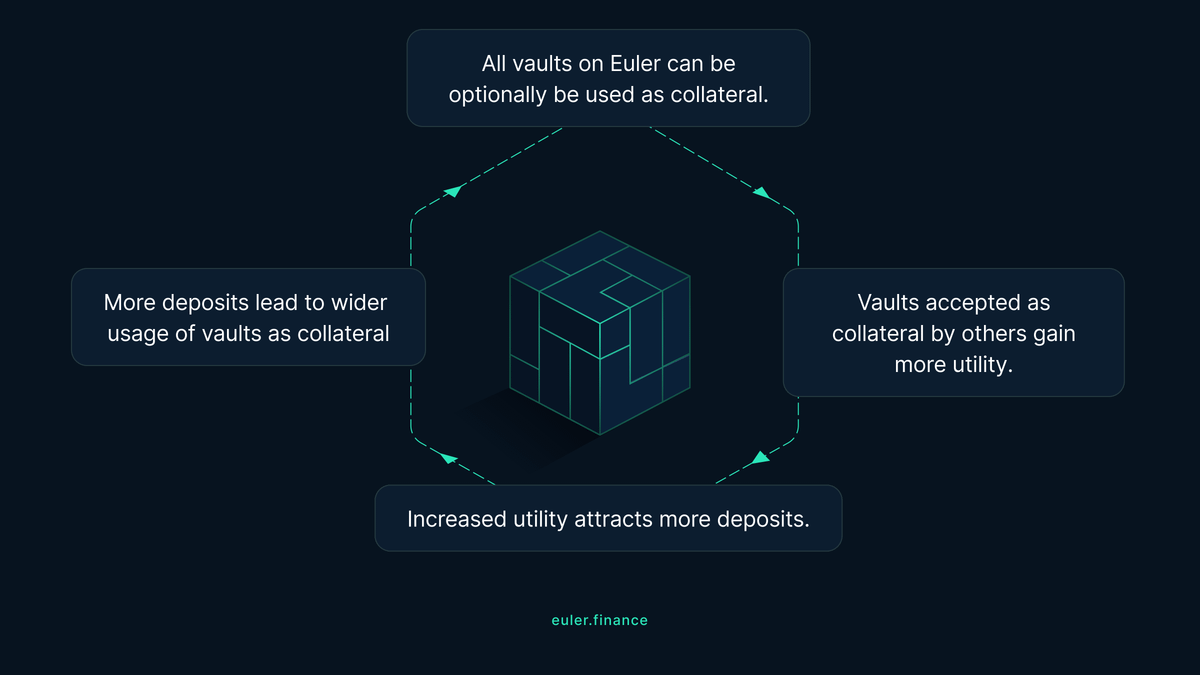

A vault can recognise deposits in any other existing vault in the Euler ecosystem as collateral. This feature, which is unique to Euler, can be used as a powerful bootstrapping mechanism for growing liquidity in old and new vaults alike. Deposits in old vaults gain new utility when they are recognised as collateral by newer vaults. Meanwhile, new vaults gain a ready-made user base for borrowing when they accept deposits from already liquid and widely used existing vaults as collateral.

Whilst vault creation is permissionless, and completely flexible, the following set of vault classes will be supported by the user interface at euler.finance:

Escrowed collateral vaults hold deposits that can be used as collateral for taking out loans from other vaults, but do not earn their depositors interest because they do not allow borrowing. They are ungoverned.

Governed vaults hold deposits that can both be used as collateral and borrowed, earning depositors additional yield. A DAO, risk manager, or individual manages these vaults, controlling risk, interest rates, loan-to-value, and other risk parameters. They are suited for passive lenders who trust the governor's management.

Ungoverned vaults have fixed parameters with no active governor to manage risk, making them suited to lenders who prefer to manage their own risk. They come in two types:

- 0x ungoverned vaults have zero exposure to governance through their collaterals

- nzx ungoverned vaults have non-zero exposure to governance because they may accept collateral with governance exposure

Yield aggregator vaults are a special class of governed vaults that aggregate passive lender assets that can be directed by the vault governor to flow into any underlying ERC4626 vault, including both ungoverned or governed Euler vaults, but also external vaults like sDAI. The vault governor manages risk/reward by altering flows into underlying vaults with different properties.

A new era of onchain credit

Euler v2 is more than just a lending protocol; it is a meta-lending platform that provides the underlying infrastructure for the credit layer of onchain finance. With the EVK and EVC, builders and institutions alike can create, connect, and optimize vaults to meet any strategy or need. From passive yield aggregators to complex lending and borrowing systems, the possibilities are endless.

Euler v2 enhances builders’ freedom to design new types of onchain credit markets. With a variety of vault classes at their disposal, builders can create a credit product from the ground up, tailored to specific user needs. For end users that means new risk/reward opportunities for lending and borrowing the crypto assets they already know and love, alongside entirely new types of opportunities via novel asset classes, such as real-world assets.

Visit app.euler.finance to start lending, borrowing, and building without limits.

This content is brought to you by Euler Labs, which wants you to know a few important things.

This piece is provided by Euler Labs Ltd. for informational purposes only and should not be interpreted as investment, tax, legal, insurance, or business advice. Euler Labs Ltd. and The Euler Foundation are independent entities.

Neither Euler Labs Ltd., The Euler Foundation, nor any of their owners, members, directors, officers, employees, agents, independent contractors, or affiliates are registered as an investment advisor, broker-dealer, futures commission merchant, or commodity trading advisor or are members of any self-regulatory organization.

The information provided herein is not intended to be, and should not be construed in any manner whatsoever, as personalized advice or advice tailored to the needs of any specific person. Nothing on the Website should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any asset or transaction.

This post reflects the current opinions of the authors and is not made on behalf of Euler Labs, The Euler Foundation, or their affiliates and does not necessarily reflect the opinions of Euler Labs, The Euler Foundation, their affiliates, or individuals associated with Euler Labs or The Euler Foundation.

Euler Labs Ltd. and The Euler Foundation do not represent or speak for or on behalf of the users of Euler Finance. The commentary and opinions provided by Euler Labs Ltd. or The Euler Foundation are for general informational purposes only, are provided "AS IS," and without any warranty of any kind. To the best of our knowledge and belief, all information contained herein is accurate and reliable and has been obtained from public sources believed to be accurate and reliable at the time of publication.

The information provided is presented only as of the date published or indicated and may be superseded by subsequent events or for other reasons. As events and markets change continuously, previously published information and data may not be current and should not be relied upon.

The opinions reflected herein are subject to change without being updated.